播客

实现零净目标的区域方法

Blue 氢 projects can qualify for millions of dollars in additional 税收抵免s by addressing upstream emissions from feedstock and power generation

尼沙蒂·戴维斯,体育博士

迈向零净值的努力

《10bet十博网址》(IRA)签署成为法律已经一年多了, 包含历史上最大的气候行动投资. IRA通过贷款为清洁能源发展拨款超过3700亿美元, 奖助金, 以及税收抵免,以促进美国的能源转型和能源安全目标. 推进这些目标的一个感兴趣的领域是氢.

氢在能源转换中起着关键作用,原因有几个. 它是一种多功能的清洁能源载体,可以利用风能等可再生能源生产, 水和太阳能, 以及像天然气这样的传统能源. 另外, 氢 serves as a form of energy storage and can help address the intermittency of renewable sources by storing excess energy during times of surplus and releasing that energy when there is a shortage of renewable power available, 从而提高电网的稳定性. 最后, 氢, 在群众的基础上, 能量密集的燃料燃烧时不产生任何二氧化碳吗. 这对重工业是有益的, where 氢 can replace or be blended with conventional fuels in situations where it is a challenge to electrify directly.

因为氢在能量转换中扮演着重要的角色, there has been an incredible amount of money allocated to ensuring that both production and consumption are heavily incentivized. The Department of 能源 (DOE) plans to award up to $8 billion in grant funding to develop several 氢 hubs across the United States. 另外, 爱尔兰共和军推出了一项新的10年清洁氢生产税收抵免激励措施:45V条款.

IRA 45V概述

虽然爱尔兰共和军已经实施一年了, 财政部对45V的全面指导尚未公布. 在高水平上, we do however know that the 生产税抵免 will be paid out based on the produced 氢’s carbon intensity (CI), with a bonus credit that increases production credits five-fold if developers meet prevailing wage and apprenticeship requirements. 考虑到这一奖金,最高信用额度细分如下表所示.

虽然碳强度括号在最初的IRA立法中已经定义, Treasury has yet to release additional guidance or regulations for calculating the life cycle greenhouse gas (GHG) emissions that will be used to calculate the carbon intensity of the 氢.

表1:氢生产税收抵免等级

碳强度(公斤有限公司2e / Kg H) | 最高信用额度(美元/公斤H2) |

0-0.45 | $3.00 |

0.46 – 1.5 | $1.00 |

1.6-2.5 | $0.75 |

2.6-4 | $0.60 |

生命周期排放和碳强度

取决于生命周期的排放边界, 生命周期评估(LCA)可以被描述为“门到门”,“从摇篮到大门”或“从摇篮到坟墓”的排放, with the latter term encompassing the total amount of greenhouse gases emitted throughout the entire life cycle of a product, 过程或系统. 它考虑了产品发展的所有阶段, 从原料提取, 加工和运输到最终使用和报废处理或回收. 45V的预期系统边界是“从摇篮到栅极”.这个边界类似于“从摇篮到坟墓”的边界, 但它没有考虑产品离开生产工厂后的排放影响, so emissions associated with transportation from the manufacturer’s production facility to the final destination, 以及与产品使用有关的排放, 不被考虑.

碳强度将产生的排放量标准化,通常以二氧化碳当量(CO)来衡量2E),以特定活动、投入或产出为单位. 在45V的情况下,碳强度以CO千克为单位测量2每千克氢(公斤有限公司2H e /公斤2).

产氢途径

有几种不同的途径, 具有不同的碳强度, 为了产生氢气,每个生产途径都被涂上了颜色分类. Green 氢 uses renewable energy sources to create electricity that is then used to split water into 氢 and oxygen atoms through a process called electrolysis. Electrolysis was discovered over two centuries ago but has not been an economical pathway to producing 氢 because it is a very energy intensive process. 然而,随着可再生能源电价的下降和对净零能源经济的推动, there is a plethora of re搜索 in this space as companies begin to scale up green 氢 production in order to take advantage of government tax incentives.

从化石燃料来源制氢, 比如天然气, 已经存在了几十年,是迄今为止最经济的制氢途径吗. 目前, 大多数商业氢气是由甲烷产生的,而甲烷通常来自天然气. 虽然经济,这个过程排放大量的二氧化碳(CO)2),被称为灰氢. 然而,捕获CO是可能的2 在它被排放到大气之前的生产阶段. 这个过程完成后,氢就被称为蓝氢.

蓝色氢温室气体排放

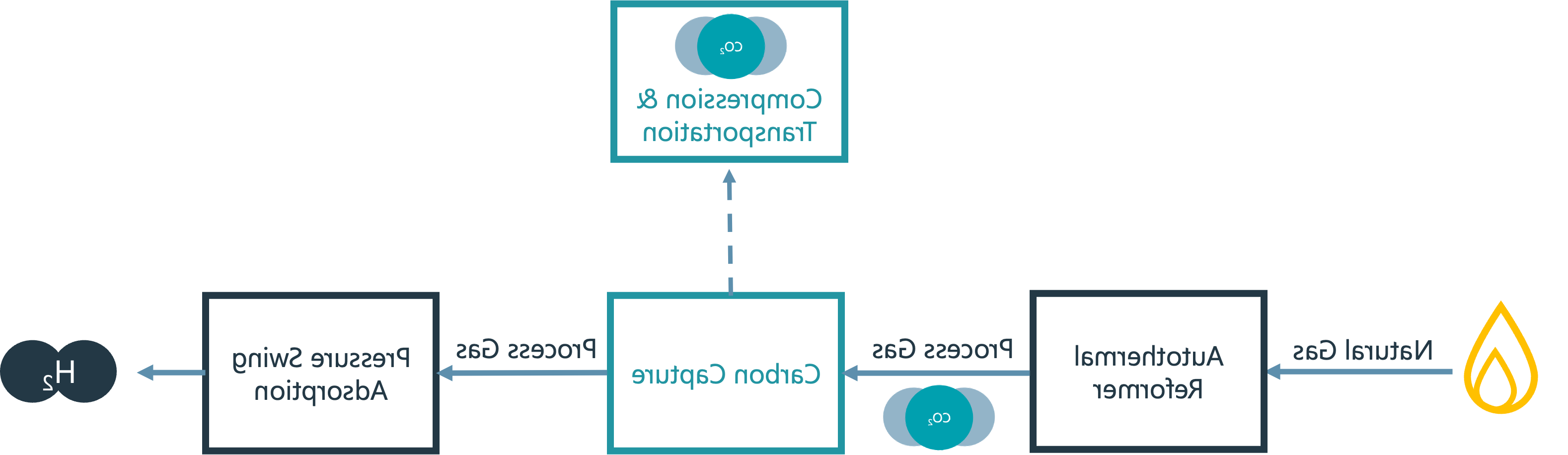

蓝氢主要由蒸汽甲烷重整(SMR)产生。, 或自动热重整(ATR),在制氢过程的下游安装一个碳捕获装置.

图1:蓝色制氢过程

在蒸汽甲烷重整和自热重整中, 相关的化学反应产生的温室气体排放量大致相同. These process emissions represent a significant share of the total GHG emissions of 氢 produced through fossil fuels. 利用最新的碳捕获技术,CO2 捕获率可达95%及以上. 这减少了温室气体的排放, 因此整体CI, 蓝氢生产过程所固有的. 然而,为了达到45V信用额度的最高等级,必须完成其他从井到栅极的减少.

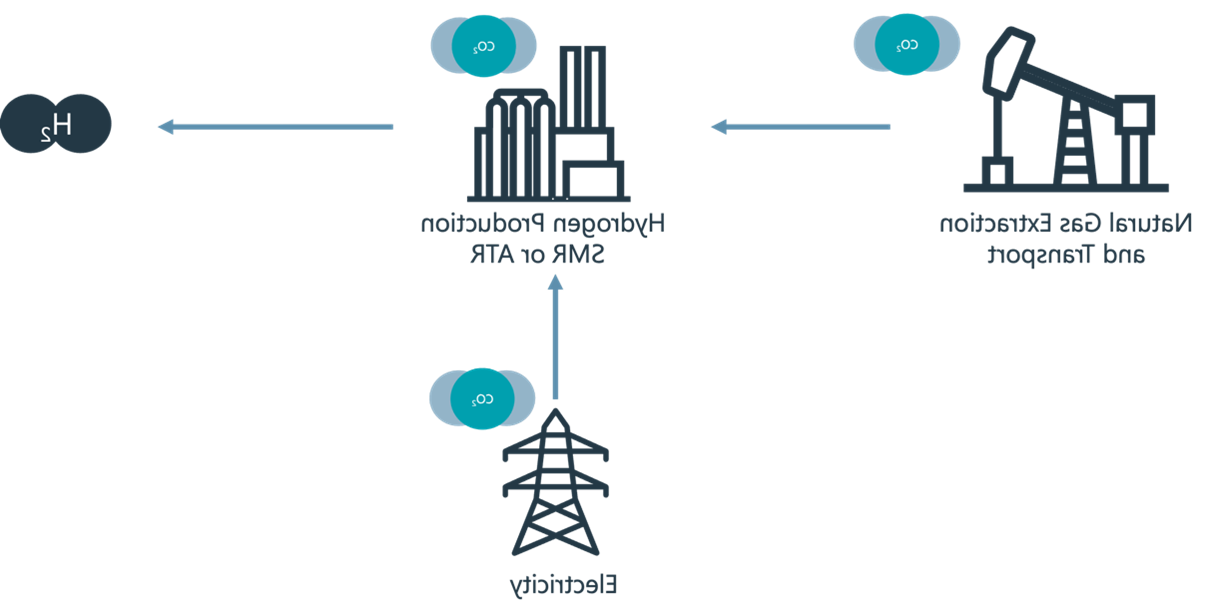

下图显示了与灰氢生产相关的从井到门的排放. There are three primary emission sources that contribute to the overall CI: natural gas extraction and transport emissions, 设施制氢排放, 以及与发电有关的排放. The International 能源 Agency (IEA) estimates the carbon intensity of grey 氢 produced from unabated natural gas to be in the range of 10-14公斤二氧化碳2H e /公斤21 这就没有资格享受政府的税收优惠了.

图2:从油井到闸门的灰氢排放

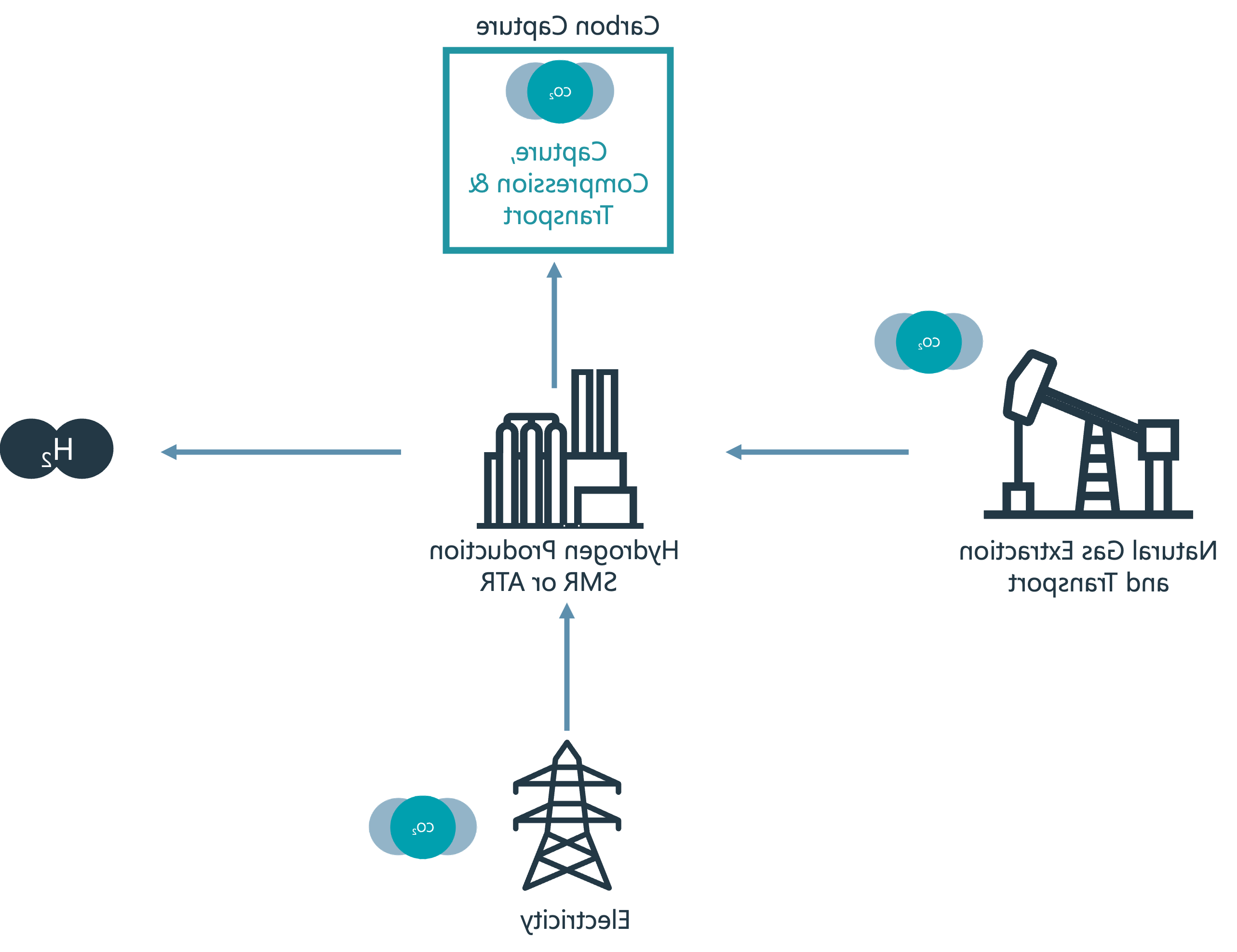

蒸汽甲烷重整制氢过程中直接排放的二氧化碳约为9千克2H e /公斤21 并且可以通过碳捕获最小化,如下面的图3所示.

图3:从油井到闸门的蓝色氢排放

国际能源署估计93%的二氧化碳2 capture from direct emissions sources within a SMR facility can reduce the carbon intensity within the production facility to 0.7 KgCO2/公斤H2, 使蓝色氢的总CI达到1.5-6.2公斤二氧化碳2e / KgH2. 为了达到这个范围的下限,上游的排放必须相应最小化.

蓝色脱碳机会

The table below summarizes the emissions sources that must be considered when computing the carbon intensity of blue 氢

表2:蓝色氢碳强度情景

蓝色氢参考案例 | 上游排放CI (公斤有限公司2H e /公斤2) | 工厂运行(95%捕获率)CI (公斤有限公司2H e /公斤2) | 电力需求CI (公斤有限公司2H e /公斤2) | 总计 (公斤有限公司2H e /公斤2) |

场景一 平均上游排放量 中位数电CI | 2.25 | 0.45 | .7 | 3.4 |

情形B 低上游排放; 中位数电CI | 0.8 | 0.45 | .7 | 1.95 |

情形C 低上游排放; 低电量CI | 0.8 | 0.45 | 0.025 | 1.28 |

使用这个表格,我们可以计算可以获得的税收抵免. Natural gas and electricity production make up a significant portion of the overall blue 氢 carbon intensity. 美国天然气的平均CI为2.49公斤二氧化碳2H e /公斤22. 这可以简化为2.25公斤一氧化碳2H e /公斤2 when removing the emissions associated with the distribution networks that 氢 plants typically do not utilize. 美国电力的碳强度中值是 .7公斤二氧化碳2H e /公斤23 并且被用来代替平均值.

场景一:

使用美国天然气的平均CI和美国电力的中位数CI, 总碳强度计算为3.4公斤二氧化碳2H e /公斤2 哪个与0美元的最低税收抵免等级相关.每公斤60 H2.

场景2:

下一个, 让我们考虑这样一种情况,即来源不同的天然气,甲烷泄漏率为0.16%2 和CI (0.8公斤二氧化碳2H e /公斤2.在这种情况下,蓝色氢的CI降低为1.95公斤二氧化碳2H e /公斤2 谁有资格得到0美元.75 /公斤H2 税收抵免.

场景C:

最后,让我们通过改用可再生能源来降低电力的碳强度. 在最后的场景中,我们的CI变为1.28公斤二氧化碳2H e /公斤2 并且有资格获得1美元.00 H /公斤2 生产税抵免.

The table below summarizes what the monetary implications of the above scenarios are for a blue 氢 plant producing 1000 MTPD H2 效率为85%.

表3:1000MTPD的税收抵免影响2 生产设备

上游排放 (公斤有限公司2/公斤H2) | 工厂操作 (公斤有限公司2/公斤H2) | 电力消耗 (公斤有限公司2/公斤H2) | 总H2 CI (公斤有限公司2/公斤H2) | 氢税等级 (美元/公斤H2) | 年度抵税额 (百万美元/年) |

2.25 | 0.45 | .7 | 3.4 | $0.60 | $175.20 |

0.8 | 0.45 | .7 | 1.95 | $0.75 | $219.00 |

0.8 | 0.45 | 0.025 | 1.28 | $1.00 | $292.00 |

上表显示了一个生产1000 MTPD H的蓝色氢气设施2 能产生292美元吗,000,如果电力和天然气是战略性来源,每年可获得6万美元的税收抵免. 与基本信贷利率相比,这是每年超过1.16亿美元的增长. 相反, facilities that do not assess their emissions associated with natural gas and power could fall outside of the base credit amount if their electricity and feedstock are procured from high emitting sources.

It is imperative that an emissions assessment be carried out to determine the actual CI associated with any specific production facility. New projects should conduct these assessments beginning in the concept phase so that decisions can be made in early design stages to minimize carbon footprint in the most economical way. 随着项目的不断发展, the emissions assessment should be updated with new and specific information to ensure that the project stays on track to meet carbon intensity targets.

结论

Although most of the anticipation for the full 45V guidance is focused on green 氢 production emissions accounting, it is important to recognize that regulations on upstream emissions accounting will also have a major impact on blue 氢. 如本文所示, emissions reductions in blue 氢 feedstock and electricity usage can result in hundreds of millions of dollars in 税收抵免s. 另外, incentivizing emissions reductions in this way furthers the United States’ goal of reducing methane emissions in upstream and midstream assets to reach net zero targets by 2050.